When do you believe you should begin preparing for your retired life? When you are a couple of months away from retirement? A couple of years? Now is the right answer. Retirement preparation is a task everyone has towards themselves. And let me tell, the earlier you understand this and shake yourselves to do something about it the better. For those who are currently on their method, provide yourself a pat on the back. Being spontaneous is fun, but when it pertains to major stages in life such as retirement you have to buckle down and take decisions and make strong plans.

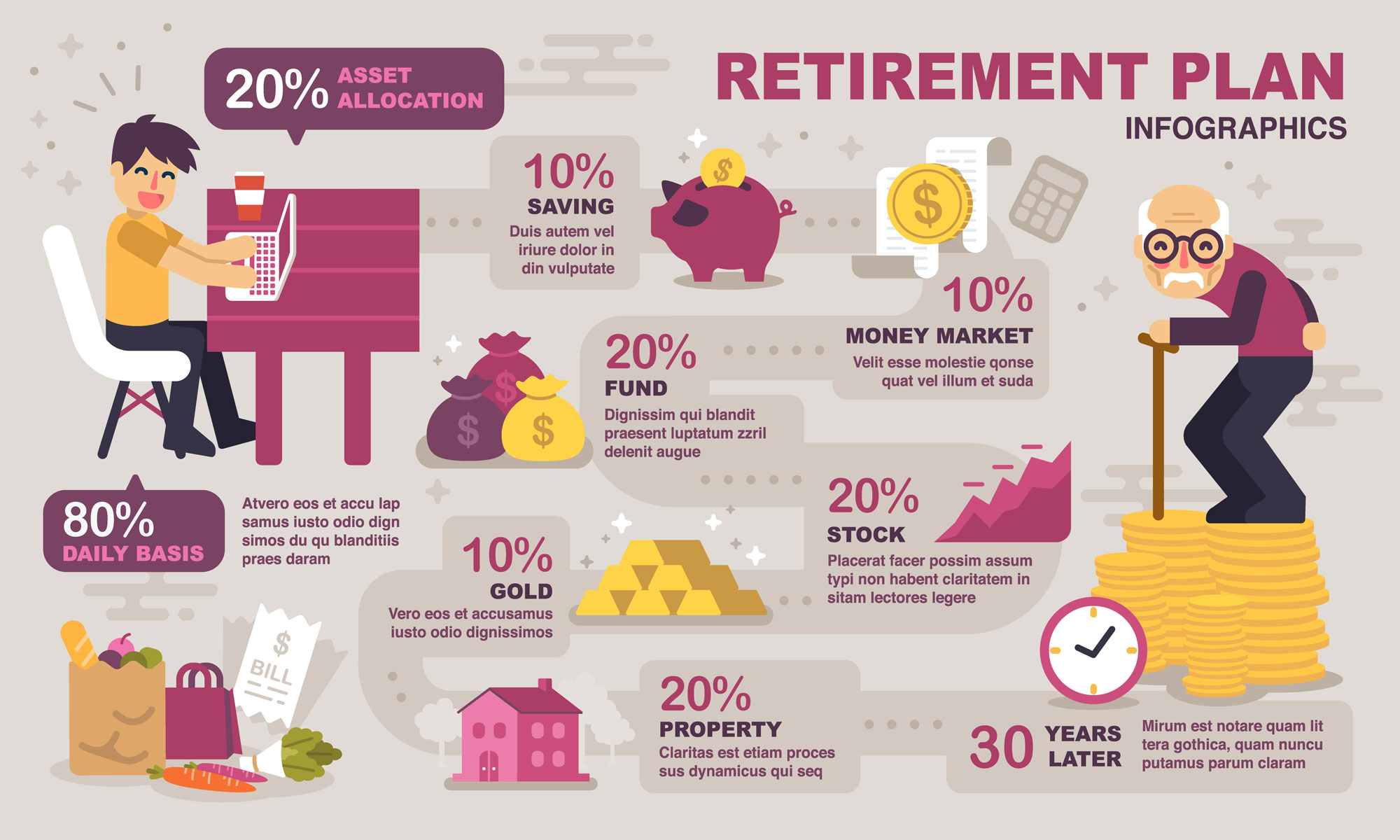

Start investing your cash, not just spending them. Try to make your cash work for you, not the other method around. Wouldn't it be great to simply sit still in your home and watch as your financial investments generate more earnings for you? It's time to study mutual funds and try your luck at it. And once you've gotten the propensity at it, you can attempt venturing into stocks trading.

Action # 7: Determine Just How Much to Leave Your Successors. Do you wish to leave money to your kids, your church or your cats? This action is where we figure out how much this will be.

Nothing is colder and lonelier than aging. Being financially self adequate can give a lot of warmth in all aspects, psychological, social and familial. There is honey if there is money. There is a data about retirement planning. To enjoy a retirement plan minimum of half the luxuries that you enjoy today, you need to conserve at least quarter of your earnings for the retirement. This is thinking about today rate of inflation. Yes it is a bit idealistic. But if we might save half of what is perfect it would give us a company assisting hand.

If you're living on interest just, use 7 percent as your average return. Merely change seven percent to a decimal and divide it into the number you selected as your yearly income. Whew! That's a lot of mathematics. If you desire a shortcut, use one of the retirement calculators online.

Start a retirement account. This will be your financial investment for the future. As an 18 year old retirement will seem a long way in the distance.but if you create a routine of putting cash aside you will discover there will still be cash for the important things that you like to do. Benefit from company subsidised strategies or contributions. You will find that countries throughout the world have different laws and various retirement plans but there is resemblance in their function. And that is that they are to offer an earnings when you reach the age of retirement. They are also referred to as pension funds and superannuation funds.

Along the very same lines of expenditures of homes, autos, and boats, you need to determine what other requirements you might have at retirement. An excellent factor to consider is that healthcare costs are climbing, and are estimated to reach soaring levels during your life time.

Retirement guidelines are not what they used to be. Only mindful and ruthless retirement planning will keep you abreast of modification and completely prepare you for your retirement.